The Government of India has raised the Tax Collected at Source (TCS) effective July 1, 2023 rate on foreign remittances under the Liberalised Remittance Scheme (LRS) from 5 percent to 20 percent exceeding an amount of Rs. 7,00,000 (Rupees Seven lakhs) in a financial year.

The UAE introduced Economic Substance Regulations in 2019 which was amended by Cabinet of Ministers Resolution No 57 of 2020 concerning Economic Substance Regulations in August 2020.

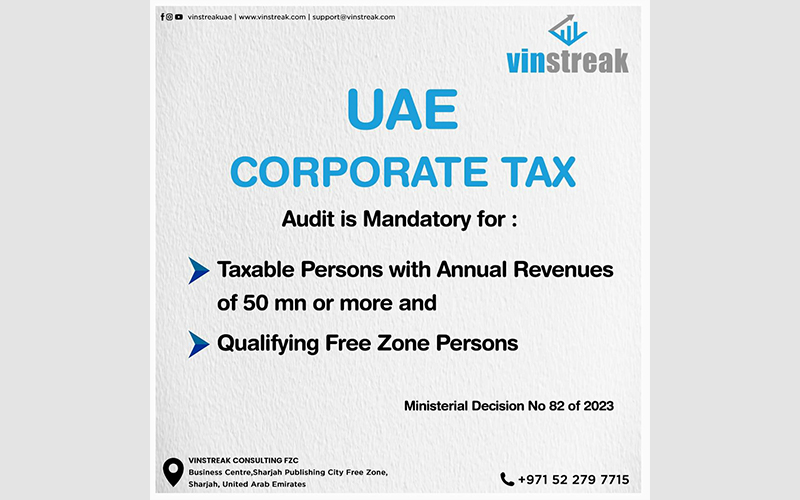

The Corporate Tax Law taxes income on both a residence and source basis. The applicable basis of taxation depends on the classification of the Taxable Person. For instance a Resident Person will be taxed on income derived from both domestic and foreign sources and a Non-Resident Person will be taxed only on income derived from sources within the UAE.

United Arab Emirates is one the few nations to follow zero-income tax policy. It is the first time in the history of UAE that a direct tax has been introduced on company profits. The United Arab Emirates is majorly a business zone and there are huge possibilities of investment and economic growth.

The impact of CEPA on business development is expected to be positive, creating a conducive environment for trade, investment, and collaboration between the UAE and India. It offers opportunities for market expansion, cost savings, increased competitiveness, and access to new sectors, stimulating business growth and economic development.

India’s trade relationship with UAE dates back to about 5000 years. The very strategic location of UAE has brought India closer with respect to trade and commerce. Indian merchants from the Indus Valley brought timber, spices and grain, while merchants in modern-day Sharjah and Ras Al Khaimah in the UAE traded copper, pottery and beadwork. It's no wonder that these two countries reflect each other's food, fabric, architecture and culture over the course of thousands of years.

New income tax slabs announced; No tax on income up to Rs 7 lakh under new tax regime